Do you want to retire on less than you’re earning now?

If the answer is no, then it’s time to make a plan.

I can help you build a roadmap toward a fully funded retirement. As a California educator, I understand the complexities of CalSTRS and CalPERS. With a Certificate in Financial Planning, I’m equipped to guide anyone—educators and beyond—toward a more secure financial future.

Let’s get started—call me at (562) 643-1962.

CalSTRS Fast Facts

Average CalSTRS Member-Only benefit after 25.2 years of service:

$67,913 / yr

$5,659 / mo

CalPERS Fast Facts

The average CalPERS member starts working at 39.1 years, works 20.3 years, and retires at 61.5.

60.4% of CalPERS service retirees receive

$3500/month or less, that's

$42,000 per year.

Social Security Fast Facts

The average Social Security benefit is:

$23,016 / yr

$1,918 / mo

Planning is powerful!

Let's consider the math...

As great as CalSTRS is, your Member-Only benefit will not replace 100% of your salary. In fact, you would need to teach for approximately 41.66 years to receive 100% of your final salary. Additionally, if you choose an option that provides a continuing benefit for your spouse after your passing, your monthly benefit will be reduced.

Planning for retirement is essential. Let me explain how your CalSTRS benefit works and help you identify any potential shortfalls. With the right strategy, you can create more financial flexibility for your retirement. The sooner you start, the better!

Scroll below to learn more about your choices!

You've Helped our Future

Let Me Help You Take Care of You

For the past 29 years, I've been a public school teacher. In my late 20s, I came across an ad for a retirement annuity and thought it would be a good investment. I believed I was doing the "right thing" by putting tax-deferred money away for future use. However, as I delved into the world of 403(b) plans, I quickly realized how complex the financial industry can make it. This complexity often serves to obscure fees and charges embedded in contracts that teachers unknowingly purchase.

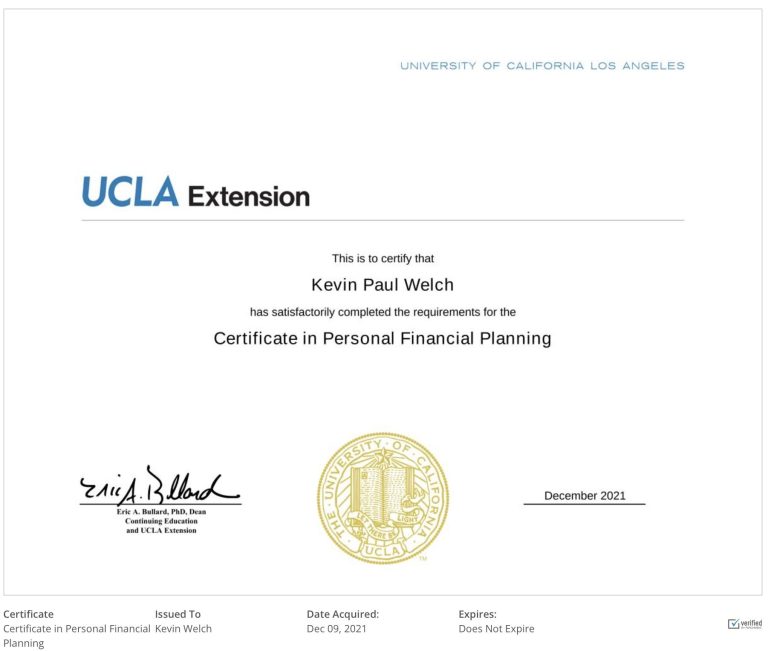

I learned the hard way how costly it can be to break free from an annuity contract. But after further research, I discovered that investing doesn’t have to be so complicated. There are companies and products available that are well-designed and reasonably priced. With this new understanding, I began asking more questions, which eventually led me to complete a school finance program and the Certificate in Financial Planning program at UCLA.

Here in California, public school teachers benefit from a strong defined benefit plan through the California State Teachers Retirement System (CalSTRS). According to CalSTRS' latest "Fast Facts," the average retiring teacher has about 25.2 years of service credit, resulting in a monthly Member-Only benefit of approximately $5,659 before taxes. For many members, living on $5,659 may be challenging.

I can help you plan to maximize your CalSTRS defined benefit and explore savings options that will support the lifestyle you envision for retirement.

Please call me at 562-643-1962, and let's discuss a path forward for the next stage of your life.

Helping Teachers Plan for their Future

Welcome to my website! As a dedicated California teacher with 29 years of experience, I understand the challenges educators face in managing their finances while focusing on their students and personal lives. My mission is to help you secure a complete financial future by providing essential financial education.

I have extensive experience working with my local teacher's union, serving on the bargaining team, and training in school finance. I have also been actively involved in protecting educators' defined benefits with CalSTRS. Additionally, I completed the Certified Financial Planning (CFP®) certificate program at UCLA, equipping me with the knowledge to guide you in making informed financial decisions. I still need to take and pass the CFP® exam.

Through my Life Financial Help service, I aim to empower educators like you with the tools and understanding needed to achieve financial security. Let’s work together to ensure your financial well-being, so you can continue to focus on what you do best—educating the next generation.

If you are a nurse, peace officer, or firefighter, I can work with you as well! I can tailor my courses and concierge services to meet the specific needs of your group.

Your Teacher Benefit

My Pension Plan: $299

Just Get Started Special $199

Do you need me to help explain your CalSTRS benefit? I can help! I will walk you through your CalSTRS benefit, including looking at your statement. Also, we can discuss 403(b) / 457 savings options that are available in your school district.

- CalSTRS Defined Benefit

- CalSTRS Defined Supplement

- CalSTRS One-Time Death Benefit

- CalSTRS Pre-Retirement Election of an Option

- Your CalSTRS Beneficiaries

- Education Planning

Click the link below to view pricing:

School Planning Concierge Service

School Planning Concierge Costs: $750

It's Summer, Let's Plan for Next Year! $550

Are you looking for someone to guide you on the path to financial independence? I can help you get started by exploring the key areas of your financial life and suggesting ways forward. I specialize in helping you see the big picture and providing a roadmap to financial independence.

What I Offer Through the Concierge Service

As part of this personalized service, I will:

Review your district's 403(b) and 457 plan offerings and recommend providers with low fees and access to low-cost investment options

- All the benefits of the "My Pension Plan"

- Assist you with the paperwork to open new accounts

- Help you—when financially appropriate—roll over or transfer funds from an existing account to a new one

- Act as a sounding board for assessing your risk tolerance to help you choose suitable investments

- Provide guidance on broader financial planning topics, including:

- Debt consolidation

- Life insurance

- Beneficiary designations

- Wills, trusts, and estate planning

- Insurance coverage review

Please note that while I will help you understand estate and trust basics, I do not prepare legal documents—this is typically handled by an attorney. When it comes to insurance, we’ll review the different types (such as term life, whole life, and long-term care), and I’ll guide you on the steps you can take if you choose to pursue coverage.

Click the link below to view SPECIAL pricing:

Retirement Planning In-depth

The Big Picture Concierge Costs: $850

The Big Picture Plan $700

Do you want to understand your CalSTRS Defined Benefit and Defined Benefit Supplement and save more for retirement? I can educate you on your pension and explore additional options like 403b and 457 plans to maximize your retirement savings. Once you understand how the system works, we can create a "set it and forget it" plan to take the anxiety out of your retirement planning. Even if you are a teacher in another state, I can review your state’s retirement plan, research the options available through your school district, and help you map out a plan for a secure financial future. This plan also includes a MaxiFi planning report. This option really starts to look at the complete financial planning process.

What I Offer Through the This Plan of Service:

- All the benefits of the "School Planning Concierge Service"

- CalSTRS Planning

- 403(b) / 457 Planning

- Life Insurance Planning

- Disability Planning

- Estate / Trust Planning

- IRA / Roth Planning

- 529 Planning

- Debt reduction

- Tax planning

As part of this concierge package, I will provide education and guidance on a range of important financial topics, including life insurance, disability insurance, estate and trust considerations, IRAs and Roth IRAs, 529 college savings plans, debt reduction strategies, and tax planning.

Please note that while I will help you understand estate and trust basics, I do not prepare legal documents—this is typically handled by an attorney. When it comes to insurance, we’ll review the different types (such as term life, whole life, and long-term care), and I’ll guide you on the steps you can take if you choose to pursue coverage.

For 529 plans, I can help you create a college savings strategy, similar to how I assist with retirement planning. In the area of debt reduction, we’ll work together to develop a plan tailored to your financial situation. And in tax planning, I’ll educate you on potential strategies to help reduce your tax liability.

Click the link below to view SPECIAL pricing:

Not Sure What you Want?

Book a Free Call-Let Me Get to Know What you Want!

Text/Call me: 562-643-1962 or email: kpwelch562@gmail.com

Certificate in Personal Financial Planning

I completed the 8-course Personal Finance Planning certificate program at UCLA Extension in 2021. This program meets the requirements to prepare for the Certified Financial Planner® (CFP®) exam. My next step is to take the CFP® exam. Certified Financial Planners are considered the gold standard in financial planning. CFP® professionals are required to work as fiduciaries, meaning they must act in your best interests.

Although I am not yet a CFP®, I promise to uphold the CFP® standards of ethics and conduct.

A fiduciary is a person or organization that acts on behalf of another person or group, putting their clients' interests ahead of their own, with a duty to preserve good faith and trust. Fiduciaries are obligated to act in the best interests of their clients and are bound by law to provide honest, transparent, and fair advice. This responsibility includes avoiding conflicts of interest and ensuring that all decisions and recommendations are made with the clients' best interests in mind.

About GEORGETOWN SANTA CRUZ II

Your Partner in Health and Finance

My wife and I own a Limited Liability Corporation called Georgetown Santa Cruz II. My wife, a Nurse Practitioner who graduated from Georgetown University, specializes in oncology. In addition to her work in oncology, she helps clients lose weight and adopt long-term lifestyle changes for healthier living. I completed my Bachelor's Degree in history at the University of California, Santa Cruz, and work as a teacher. My focus is on educating teachers on how to make informed financial decisions to reduce stress and improve their overall well-being.

Who We Are

Highly qualified and motivated professionals

My wife, Mary, is a Nurse Practitioner specializing in oncology. Outside of her clinical work, she assists clients in making lifestyle changes that promote weight loss. She holds a B.S. in Nursing and an M.S. as a Nurse Practitioner from Georgetown University, with over 30 years of experience in the medical field. If you are looking for a weight loss/health coach go to: http://weightlosstowellness.org.

And that’s me, Kevin. I’ve dedicated 28 years to teaching and have served on my local bargaining team, gaining expertise in school finance. I completed Certified Financial Planning certificate at UCLA, although I haven’t yet taken the CFP® exam. Despite this, I possess extensive knowledge to educate you on critical aspects affecting your financial future. As President of my local and Chair of the California Teacher's Association Retirement Committee, I actively participate in CalSTRS Board meetings to ensure the continued provision of pension benefits for our 300,000 CTA members.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.